Price dynamics in sectors sheltered from international competition, particularly services, directly affect producer prices and the competitiveness of manufacturing firms via the cost of inputs used to produce manufactured goods.

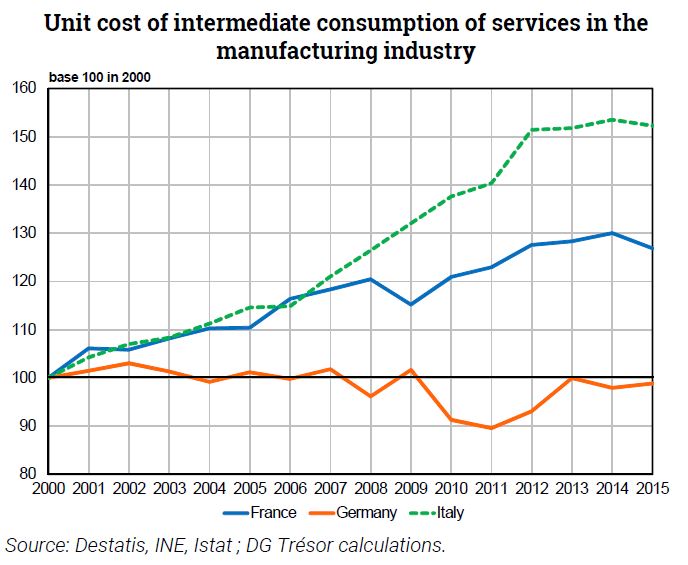

Prior to the financial crisis (2000-2007), buoyant service prices in France and Italy exerted upward pressure on the prices of manufactured goods. Specifically, the strong rise in service labour costs impacted industry via higher service selling prices. In Germany on the contrary, wage moderation and deregulation in the professional business services sector (accounting, legal services, architecture and engineering) reined in rising service input costs in manufacturing during the same period.

In this context, French and Italian manufacturers have cut their margins to curb producer prices. Concurrently, in Germany, firms were able to significantly boost their margins because of the weak cost increases in manufacturing – both in terms of labour costs and intermediate input costs.

French manufacturing’s efforts to tighten margins allowed it to keep its prices in line with Germany. In Italy, these efforts were not sufficient to preserve price competitiveness, which also deteriorated as a result of strong unit labour cost (ULC) momentum in the manufacturing sector itself, in contrast to France.

Between 2010 and 2015, service input costs rose more moderately in France and helped rebuild the margins of industrial companies, while ULCs tended to steepen in Germany for both manufacturing and services. In Italy, the still relatively buoyant input costs prevent manufacturers from significantly restoring their margins, even though the country is no longer losing price competitiveness against Germany.