Trip to America

The announcement of a rescue plan to support the US economy of USD 1.9 trillion (i.e. about 9% of GDP, on top of 4% decided in December) has raised controversy over the proper size of emergency and stimulus plans. For Larry Summers and Olivier Blanchard, yet fervent supporters of expansionary fiscal policies, this programme is too massive because it is between 2 and 4 times the output gap expected for 2021: with a unit multiplier, its implementation would boost demand far above the country’s production capacities. Inflation would start to rise again, causing the Federal Reserve to hike rates, lessening the impact of the fiscal stimulation, in line with the good old IS-LM model, or worse, triggering a financial crisis. The inflationary risk would even be higher since the savings accumulated by American households since the start of the crisis is approximately twice the amount of the stimulus plan envisaged by the Biden administration: if half of this savings were consumed, that would double the stimulus provided by this new relief package.

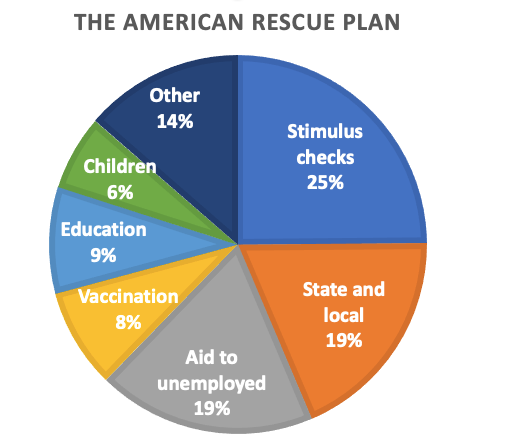

This view is vigorously contested by several economists including Gauti Eggertsson and Paul Krugman. For them, the goal is not to bring the GDP as close as possible to its potential level, but rather to speed up vaccination, reopen schools, provide support to households weakened by the crisis as well as to states and municipalities to dissuade them from laying off their staff and shutting down public services (see Figure 1). All the funds will not necessarily be spent (it will depend on the evolution of unemployment) and even so, it is not that obvious it would trigger inflation as the estimates of the output gap and its link to inflation are uncertain. And after all, wouldn’t it be good news if inflation started to rise again?

Figure 1. Components of the Biden rescue plan

Source : Krugman (2021)

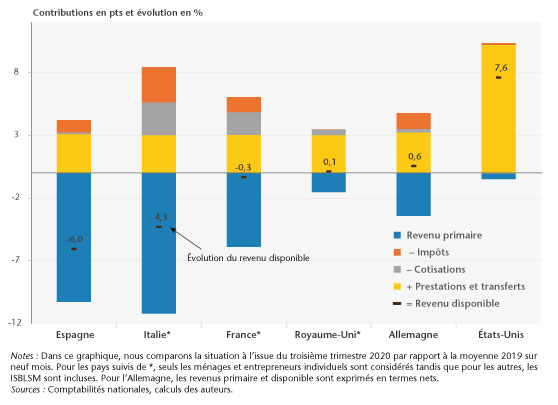

Paul Krugman does not speak of a stimulus package, but rather of a ‘disaster relief plan’, or even of war spending, which cannot be decided on the basis of a macroeconomic analysis. Although inflation has often accompanied war efforts, he stresses that beneficiary households and communities will not hesitate to spare some of the funds received, thereby reducing the pressure on prices. Blot, Dauvin and Sampognaro have calculated that public transfers have overcompensated the income losses of American households in 2020 (see figure 2), without noticeable effect on inflation.

Figure 2. Contribution to household disposable income at the end of the third quarter in 2020

(First three quarters of 2020 relative to same period in 2019)

Source : Blot, Dauvin et Sampognaro (2021)

For Blanchard and Summers, aid to victims could be better targeted and at least partially funded by the winners of the crisis. They do not worry about the size of the Biden plan, but about its concentration on current spending in 2021, when the country critically needs to catch up in public investment, over several years. They warn against the illusion of inflation being gone for good. A few years ago, they recall, negative interest rates were inconceivable. You can never tell.

For Blanchard and Summers, the relief plan must be adequately calibrated, but not too generous, so as not to cause inflation or windfall effects. If it turns out to be insufficient, it will always be possible to increase it. Eggertsson and Krugman want to strike people’s minds with a massive plan to suddenly pull the country out of the rut by reversing expectations and accepting windfall and inflationary risks.

Note that none of them raises the issue of the additional debt that will arise from the plan. They probably consider that a further increase in debt by 9 points of GDP is painless as long as the interest rate is lower than the growth rate. They therefore assume a zero opportunity cost for public money in the country of the dollar.

Back home

Is the Biden relief plan good news for the Eurozone and for France? The IS-LM model in an open economy (or Mundell-Fleming model) gives us a straightforward answer: “it depends”. The stimulus plan will indeed trigger U.S. imports that will benefit our businesses; but a rise in long-term interest rates in the United States could contaminate other parts of the world, notably the euro area. Ultimately, it will go well if the dollar appreciates, as suggested by the standard model, which does not take into account, for example, the risk of the Fed being subject to fiscal dominance (see Jean-Pierre Landau).

Should the euro zone or at least France follow suit? By setting an upper limit not to the public debt ratio, but to the “likely” interest payments relative to GDP, Xavier Ragot estimates that there is room for a second French stimulus plan of € 100 billion (around 5% of GDP). The reasoning is neither Krugman’s “whatever it takes” nor Blanchard and Summers’s “whatever is needed”. It is rather a matter of “as much as possible”: take advantage of low rates and use all available space to borrow and finance capital expenditure, which will be spread over several years.

What does that say? For 2021, French GDP is still expected to remain below its 2019 level, with the gap ranging between -3% and -4% according to forecasters. Before the crisis, the European Commission forecast for France a growth of 1.3% in 2020 and of 1.2% in 2021. Without Covid, the GDP of 2021 should therefore have been 2.5% above its level of 2019. The total loss compared to this counterfactual would therefore be in the range of 6 to 7% of the GDP, i.e. around € 140 to € 160 billion. One might therefore think that an additional stimulus plan of € 100 billion would not only be welcome, but also be insufficient. This reasoning is however inadequate, for three reasons.

The first reason is the weakening of the level of potential GDP: the counterfactual of 2.5% above the 2019 level is inaccessible in the short term because the fall in investment and productivity have weakened the supply of goods and services at least temporarily. The right short-term objective is therefore to return to the production level of 2019. The second reason is that the government’s recovery plan (‘France relance’) – € 100 billion mainly for 2021 and 2022 – is ramping up and it is far too early to consider it to be insufficient. The third and main reason is that the health situation is not yet normalized: when restaurants, theaters and other sports halls are closed, it is vain to believe that the activity can regain the level of 2019 by increasing demand. The most severely hit sectors (transport, accommodation and catering, arts and entertainment) account for 10% of GDP. Considering these sectors, which were operating at ¾ of their capacity in the 4th quarter of 2020 and ⅔ in November, will keep operating at low levels during the first half of 2021 and would rise in the second half of the year to a level close to that of the third quarter of 2020, the loss of GDP for these sectors alone compared to 2019 would be in the range of 2 ½ points, i.e. about half of the overall GDP loss, currently estimated at -5% by the Banque de France, or -4% in January by Insee.

This gap of some 2 ½% cannot be closed until the health crisis is behind us. However, for most forecasters, the French economy will likely return to its 2019 level next year. If, once the health constraints are lifted, recovery proved slower than expected – which can be closely monitored thanks to high-frequency data that are now swiftly made available – , then an additional boost to demand would appear adequate. For now, the 2020 experience rather shows that economic rebound can be quite sharp once health constraints are alleviated. Sound risk management would advocate in favour of keeping the additional fiscal space to face new unforeseen events. The low level of interest rates does not invalidate the reasoning, not to be mistaken with the long-term public investment strategy whose objective is long-term growth rather than short-term recovery.

In the immediate future, the best indicator to assess the effectiveness of public action on the economic front is the situation of businesses and households in their diversity: for several more months, the “whatever it costs” must be considered from a microeconomic perspective (accelerate vaccination, protect businesses and households weakened by the crisis) rather than from a macroeconomic perspective (restore the level of GDP). Things will change when health constraints are finally lifted.

Read more :

>> Version française : Quoiqu’il en coûte, c’est combien ?

>> All posts by Agnès Bénassy-Quéré, chief economist – French Treasury