Why a recovery plan?

An astronaut returning from a space mission would no doubt be incredulous at how severely the world economy has deteriorated in just a few months. The crisis is particularly dramatic in developing economies. Within advanced economies, France is one of the hardest hit countries due to a severe lock-down in the spring and its strong specialization in highly affected sectors (aeronautics, tourism).

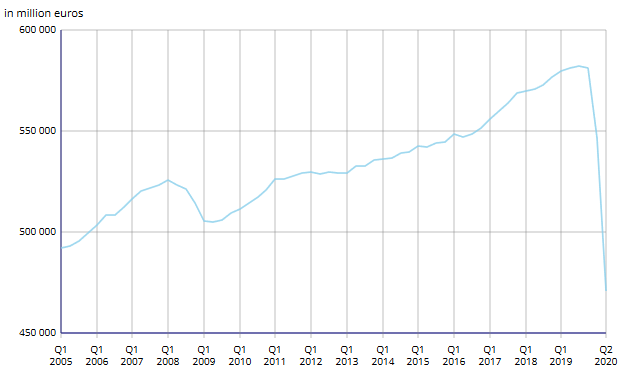

On August 28, INSEE published its new growth estimate for the 2nd quarter of 2020: –13.8%, after –5.9% in the first quarter. The fall is sharp – much worse than in 2009 (Figure 1).

Figure 1. Real GDP

(at previous year chained prices, seasonally adjusted and corrected for working days)

Source : Insee, Informations Rapides, August 28 2020.

However, the crisis is of a completely different nature to the Great Financial Crisis, and the policy responses are also different.

The 2009 crisis was clearly a debt overhang crisis: excess leverage of poor American households, of American and European banks, and of some European governments. The crisis was mitigated by expansionary macroeconomic policies and by an international commitment not to erect protectionist barriers. However, deleveraging is a slow process. Furthermore, the Europeans withdrew their macroeconomic support too quickly, which produced a second dip in 2011-12.

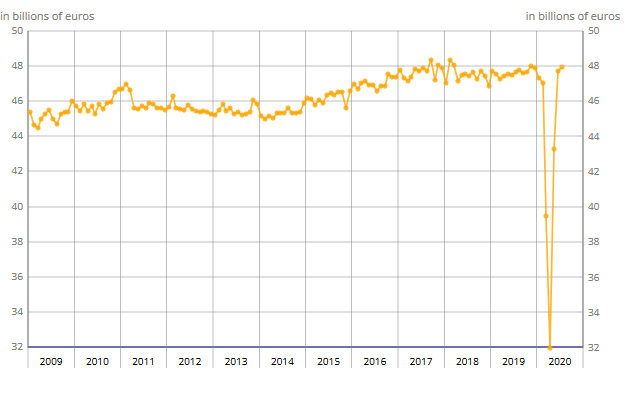

After the 2009 crisis, significant efforts were made to re-regulate the financial system and recapitalize the banks. The latter are now better equipped to deal with possible defaults from the borrowers. In addition, governments and central banks have deployed huge means to support businesses and households during lockdowns (see here for the case of France). These efforts have paid off: the rebound in consumption was spectacular in France during the summer (Figure 2), and corporate bankruptcies have so far been contained.

Figure 2. Monthly household consumption of goods

Volumes at the previous year prices (chained since 2014)

Source : Insee, August 28 2020

However, the recovery is uneven across sectors and it has slowed down in late summer. With contaminations rising again in the fall, the economic outlook for the end of the year remains highly uncertain. Unfortunately, other risks also loom over the world economy, e.g. on international trade.

What recovery plan?

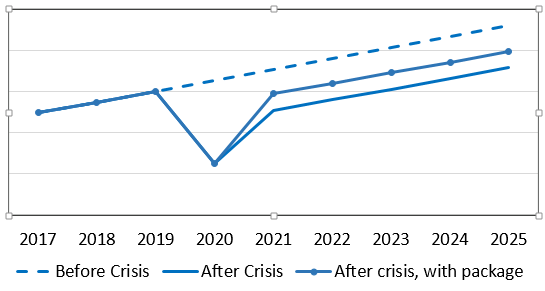

The objective of the French recovery plan is to bring the economy back as quickly as possible to a growth trajectory that should be as close as possible to its pre-crisis path, represented by the dotted line in Figure 3. The short term and long term are linked insofar as the short-term crisis produces injuries that may prove to be lasting: companies in difficulty as a result of the crisis are not necessarily the least productive,[1] the lack of investment in the short term will constrain production capacities in the medium term, unemployed workers may experience deskilling, etc.[2]

After plummeting in 2020, GDP should bounce back in 2021. Based on past crises, though, the spontaneous rebound will unlikely bring activity back to the dotted line (see for example the 2009 crisis on the figure 1). Moreover, the recovery will be slowed down by persistent uncertainties on the pandemic front and on the labour market. Certain sectors remain constrained or even closed; the household saving rate, which jumped during lock-down, could remain at a higher level than before the crisis due to precautionary behaviors; and companies will lack visibility to spontaneously embark on ambitious investment programs.

Figure 3. Macroeconomic stimulation : short-term and long-term

GDP before and after the Covid-19 crisis

Source : French Treasury

It is in this context that the recovery plan was unveiled on September 3. The idea is to tackle the economic crisis at its root – in the accounts of companies – so that they can retain their workforce, hire young workers, invest and modernize. Before the crisis, the National Productivity Council pointed out the weaknesses of the French production system: skills mismatch, digital lags, insufficient return on research and development, heavy production taxes.[3] These weaknesses did not disappear with the crisis. We must therefore take advantage of the recovery plan to correct them, while helping companies transform their growth model to make it compatible with the energy transition, without sacrificing their competitiveness. The objective is both to stimulate the rebound in 2021 and to raise the level of GDP and – why not – its growth rate in the long term.

[1] See Mattia Guerini, Lionel Nesta, Xavier Ragot and Stefano Schiavo, “Firm liquidity and solvency under the Covid-19 lockdown in France”, OFCE Policy Brief n ° 76, July 2020.

[2] See Valerie Cerra, Antonio Fatás and Sweta Saxena (2020), “Hysteresis and the business cycle”, CEPR Discussion Paper 14531, March.

[3] National Productivity Council, First Report, July 2019.